By Suraj “Jarus” Oyewale

May 2013

A bill is a draft of a proposed law that is still undergoing legislative scrutiny. When it is passed by the National Assembly, it becomes an Act. No other bill has been more popular since Nigeria’s return to democratic rule in 1999 than the current Petroleum Industry Bill (PIB) – maybe the Freedom of Information Bill comes near. The reason is not far-fetched: anything petroleum in Nigeria generates passionate interest.

Every lettered Ade, Ada and Adamu is aware that there is a contentious bill by the name PIB, but other than the professionals – journalists, informed oil sector workers, regulatory and professional services providers, industry watchers and analysts – and some politicians, few people understand what the PIB is about. In this essay, I have attempted to explain the PIB in the most basic of terms.

WHAT IS PIB?

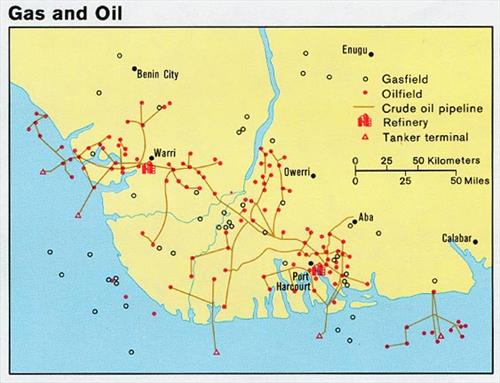

PIB is a bill that, when passed as an Act, becomes the master reference law that governs the Nigerian petroleum industry – from the upstream division (exploratory, development and production activities) through the midstream (gas processing) to downstream (servicing, refining, distribution, transportation, marketing/retailing).

BACKGROUND

Shortly after President Olusegun Obasanjo assumed office in his first term, he set up a committee, called the Oil and Gas Industry Committee (OGIC), with a mandate to take a comprehensive look at Nigeria’s oil and gas sector and offer better ways of managing the industry. Obviously, many of the laws and regulations guiding the industry had been around for long, some far back 1950’s, and although they had undergone amendments, the federal government considered it necessary to take an holistic review of the industry with a view to getting the best of it by all stakeholders. The OGIC was led by Mr. Rilwanu Lukman, veteran petroleum engineer and former Secretary-General of OPEC, and had other oil industry eggheads. The committee submitted its report, and its recommendations formed the basis of Petroleum Industry Bill, which has since been subjected to further reviews and adjustments.

WHAT DOES PIB SEEK TO ACHIEVE?

The Bill seeks to:

• Create a conducive business environment for petroleum operations

• Enhance exploitation and exploration of petroleum resources in Nigeria for the benefit of Nigerians

• Optimize domestic gas supplies, especially for power generation and industrial development

• Encourage investment in Nigerian petroleum industry

• Optimize government revenue

• Establish profit-driven oil entities

• Deregulate and liberalize the downstream petroleum sector

• Create efficient and effective regulatory agencies

• Promote the development of Nigerian content in the oil industry

• Protect health, safety and the environment in petroleum operations

KEY IMPLICATIONS/OBJECTIVES TO NOTE FROM THE ABOVE

• More jobs for Nigerians – as it will become illegal to employ foreigners for certain skills that can be sourced locally

• Where such skills are sourced from abroad due to unavailability locally, a local understudying the expat is a requirement

• The above is applicable not only to skill, but to materials sourcing

• The above means more jobs for Nigerian local contractors, especially those from the oil producing regions

• Gas is still under-focused in Nigeria and the potential from this source of energy lays untapped. PIB seeks to maximize this. If well explored, this will boost power supply in Nigeria

• Government revenue from oil industry will increase. This means more funds in the hands of government to engage in developmental activities, ideally

• The downstream sector becomes fully deregulated. In other words, subsidy will fully go.

• Subsidy removal is not totally bad, if there are no distortions to market – this is my personal opinion as an economist (well, accountant with academic training in economics)

• Environmental protection – what Saro Wiwa and co fought for, and the initial grudge of the Niger Delta militancy – will be addressed to a large extent

WHO OWNS THE OIL?

The PIB vests ownership and management of all petroleum resources, offshore or onshore, in the Federal Government of Nigeria, which manage them on behalf of all Nigerians. This means irrespective of where the oil is found, it belongs to the government of Nigeria. Of course, equity calls for special consideration for localities where the resources are mined. This is taken care of by the Revenue Sharing laws and other provisions of this Bill like the Host Community Fund.

NOTABLE AGENCIES THAT WILL BE ESTABLISHED OR RESTRUCTURED BY PIB

- •

THE PETROLEUM TECHNICAL BUREAU (PTB):

This will be a special unit under the office of the Minister of Petroleum. It will be peopled by professionals from both the upstream and downstream sectors and charged with the responsibility of rendering professional support to the minister.

• THE UPSTREAM PETROLEUM INSPECTORATE (UPI):

The UPI will regulate technical and commercial activities in the upstream sector. It will be responsible for issuing licences and permits. Representatives of Federal Mistry of Finance, NUPENG, PENGASSAN etc will be part of UPI board, in addition to other professionals appointed by the president. The UPI is not profit-driven, but regulatory, it will therefore not pay income tax.

- •

THE DOWNSTREAM PETROLEUM REGULATORY AGENCY (DPRA):

This is to the downstream industry, what the UPI is to the upstream industry. So if you want to set up a filling station, for instance, you approach DPRA. It is also in charge of petroleum pricing monitoring and regulation (what PPRA currently does)

Note that the Directorate of Petroleum Resources (DPR) currently does the bulk of what UPI and DPRA will be doing. In other words, PIB unbundles DPR into UPI and DPRA.

• THE PETROLEUM TECHNOLOGY DEVELOPMENT FUND (PTDF):

The PTDF will continue to exist. The objective of the PTDF is to develop and train manpower necessary to service the petroleum industry in Nigeria. The body gives scholarships to Nigerians, sponsors and supports researches etc

• THE PETROLEUM EQUALIZATION FUND (PEF):

The PEF continues to exist under the regime PIB seeks to introduce. The PEF is responsible for accounting for the ‘subsidy’ – the leverage given to Nigerians by making oil marketers sell at prices below market price i.e equalizing. But what is unclear to me is how this will continue to exist when subsidy will be totally removed. But my guess is the continued existence will be to take care of the backlogs in the equalization funds accounting or to continue its function until after final subsidy is finally removed, when it will be scrapped.

• THE PETROLEUM HOST COMMUNITIES FUND (PHCF):

Host communities are communities where petroleum resources are found i.e the Niger Delta and other areas it will be found in the future (like my village in Kwara…lol). The PIB will require oil and gas producing companies to contribute an amount (10% of their profits after adjusting for Hydrocarbon Tax and Companies Income Tax) into this Fund. The funds will be used to develop the economy and infrastructure of these communities. A community that still goes ahead to destroy assets of companies producing in their locality will forfeit their share of PHCF. A good deal, if you ask me.

• THE NATIONAL PETROLEUM ASSETS MANAGEMENT CORPORATION (NAPEMC):

The NAPEMC will be responsible for managing government investments in the upstream industry. It will have subsidiaries to carry out different aspects of these activities. It will take over assets and liabilities of NNPC, will be incorporated and fully profit-driven. It is not a regulatory entity. NNPC employees shall be transferred to this entity.

• THE NATIONAL OIL COMPANY (NOC):

This will also be an offshoot of NNPC, but unlike NAPEMC which will be a limited liability company, the NOC will be listed on the Stock Exchange, meaning you and I can buy its shares. Up to 30% of its share will be available for grabs by the public. Certain employees, assets and liabilities of NNPC will also be transferred to the NOC.

• THE NATIONAL GAS COMPANY (NGC):

This will also be listed as a PLC and certain employees, assets and liabilities of NNPC will be transferred to it.

TAXATION

The PIB effectively repeals the Petroleum Profits Tax Act (PPTA), which has been governed fiscal framework in the upstream sector pre-PIB. Upstream oil and gas companies will now be subject to:

• Companies Income Tax (CIT): Like the downstream businesses. It remains at 30% of adjusted profits

• Nigeria Hydrocarbon Tax (NHT): This is a new tax to be introduced by the PIB for upstream operators. The rate is 50%

Roughly, the effective tax rate in the upstream industry comes to around 80%. It should be noted the repealed PPTA ranges from 66.75% to 85%. So it may be net benefit or hit to companies depending on their operations.

Education Tax remains unchanged at 2% of assessable income.

CONCLUSION

Although I have summarized the PIB in layman language, it no doubt goes beyond this. A lot of technical jargon and complexities have been left out to avoid derailing from the objective of this article. It should also be noted that the PIB has not been finally passed, but this essay is based on the latest version as at the time of doing this summary. There will surely be changes to the Bill before the final version is passed into law, but the major areas covered in this write-up are not expected to significantly change.

***

For more articles like this, subscribe free to JarusHub

[subscribe2]

Established in March 2013, JarusHub is a Nigerian information hub with focus on career and management. It is rated Nigeria's most authoritative destination for online career resources. It parades an array of Nigerian professionals who share their career experiences with a view to bridging career information gap and mentoring a generation to success. Whether you're a student, a recent graduate or an established professional, or even an executive, you will always find something to learn on JarusHub. All enquiries to jarushub@gmail.com or 0808 540 4500. Facebook: www.facebook.com/jarushub; Twitter: @jarushub or @mcjarus.

Path to Big 4: Stream 11

April 4, 20245 Best Useful Applications Of AI in Modern World

November 17, 2023

Thanks for dis layman approach. However, I still need more clarification on the host communities. Is it a place where petroleum is found or where it is refined or both?

Where it is found, drilled, produced. Not where it is refined.

Sent from my BlackBerry wireless device from MTN

An informative piece. I opine this long list of agencies will complicate the protocol of bureaucracy, especially when in “Govt hands”. At the upstream, the PTB may be incorporated into UPI (all acronyms as defined above), And the regulatory Inspectorate will take personnel from Research Institutes, Universities, Professional bodies and likes.

Also, there is the need for an agency to administer petroleum installations (onshore/offshore)-via a vis security and maintenance. Perhaps, NAPEMC, it will look into safety of oil/gas routes,pipelines integrity, preparedness of facilities for emergencies/vandals and likes.

Nice points you made there.

Sent from my BlackBerry wireless device from MTN

Left to me, PHMC isn’t really necessary in a setting where State Govts. of host community are fair and transparent to their people. Apart from the “sharing formulae” from FG, agencies like PHMC,NDDC will only gulp money itself with little or no result to show (hope i wont offend my ijaw bros). Rather, any agency set up should look into accountability of the “shared allocation” to host communities. In Qatar,Oil was only first found in “Dukhan” and the residents at no time never felt they deserve a separate/additional income from the Emir/Ministry. So is the situation in other gulf regions, even Norway too. (few that I know).

I agree with you 100% – this is duplication, in fact multiplication, of shares of the host region. The state governments have extra cut of the pie thru derivation principle, there is the NDDC levy too, which is 3% of annual budget of oil companies operating in the region (administered by NDDC), there is teh ministry of Niger Delta too, now the PHCF at 10% of profits of the companies. To me, this is giving too much. This is one of the contentious parts of the PIB generating furore in the NA, especially from leagislators from non-ND region, particularly North. I don’t see it being expunged though.

On the flipside, the tying of the fund to conduct of the communities, may be a commendable measure.

thanks for the insightful analysis

If only the supporters of the PIB could break it down like this for everyone to understand then maybe the bill would have been passed. The supporters of this bill have cared less about the concern of opponents, just like you rightly mentioned, the host community fund in addition to all other packages on ground for them already and rather than trumpet more of the advantages of the bill like you have again highlighted, they are busy coercing people to support the bill through bribery. Last year, the minister of petroleum asked for 6 Billion Naira in the appropriation of her ministry’s budget to lobby people and do some other sensitization of the public for the smooth passage of the bill. And that means what by the Nigerian context. I do not see the bill passed soon, if all the grey areas are not removed. The Northern house of representative members have not hid their grievancess about the clauses in the bill and if it remains so, the bill may not see the light of the day soon..

[…] week on this platform I did an analysis of the current version of the Petroleum Industry Bill (PIB) – that contentious bill that has turned every Tunde, Emeka and Haruna to oil industry expert. […]

[…] Also, to be abreast of the local developments, I once did a review of the Petroleum Industry Bill. You may also want to read it here: PIB FOR DUMMIES […]

[…] Much as we wish to do, we will not be able to pay such thought leaders for their contribution, but we hope to be able to do in the future. However, such contributors are free to promote their business interests in their write-ups. This is also an avenue for those that have not made names already to build authority status. People respect you when you regularly write something that makes sense, and you gradually build authority on the subject such that you get invitations from left, right and center for engagements. I am living testimony to this. Just two days ago, I got invitation from a popular radio station in Abuja to come and discuss PIB. They got to know about me through an article on PIB I wrote on this blog months ago. […]

[…] First appeared on Jarushub Career Mentorship & Management Program […]