By Suraj Oyewale

My first article to be published in a national daily appeared in the Punch edition of May 9, 2003. I just finished year one in the university and what was supposed to be a three month break stretched into almost a year as OAU’s internal crisis rolled into ASUU national strike and the much awaited resumption into year two never seemed to come. Since then I had gone ahead to write over a hundred articles that have been published in newspapers, online portals and blogs. But anybody familiar with my interventions knows that they border more on politics than economics and accounting – two areas I have my academic and professional training. This blog having primary focus on career, mentorship and education, I believe, should be an avenue to take hiatus from political writings and discuss professional matters. Hence, my decision to dwell more on professional issues in this column. Of course, I shall also be intervening in topical political issues, since politics can hardly be divorced from any aspect of our national life.

I have decided to discuss taxation in the first few weeks of this column to enlighten non-professionals on the increasing recognition of the place of taxation in any economy by our government. Many years ago, taxation was hardly a major issue by the government of Nigeria. Several reforms spearheaded by the erstwhile Chairman of the Federal Inland Revenue Service (FIRS), Mrs. Ifeuko Omoigui, have raised awareness on taxation in Nigeria. The efforts of two successive governors of Lagos state, Bola Tinubu and Babatunde Fashola, accountant and lawyer respectively, to boost internally generated revenue in the state, and the success recorded have also emboldened other states to seek to optimize their revenue generating capability. Today, a non-oil producing state like Lagos and an oil-producing one like Rivers rake in billions of Naira in taxes on monthly basis from IGR. Many businesses and individuals, who thought they had played smart all these years escaping taxes, are now being caught in the tax net as federal and state governments become more aggressive in their tax drive. This is why everyone needs to know one or two things about taxation.

In advanced societies, taxation is a very critical part of public policy and political discourse. You often hear tax (cut) policy being passionately debated in American politics, and you hardly hear anything like that here. Even as contentious as the Petroleum Industry Bill (PIB) is, the points of contention have not been the fiscal regime. All these show that we still have a long way to go in policy discourse in Nigeria. But who will participate in the debate when the populace don’t even seem to be tax-aware. So it is my aim in this column to contribute my little quota, within my limited knowledge, to the raising of a tax-conscious population.

Next week by the grace of God, we shall be discussing in general terms what taxation is about before we move on to the various types of taxes and what the obligations of you and I are. As much as possible we shall keep the discourse simple, devoid, as much as possible, of professional jargons. Other professionals are also invited to contribute either through the comment button or email us articles for publication. Together we shall raise a tax-literate generation.

If you found this article beneficial, kindly share on Facebook and Twitter using the buttons below.

Please subscribe to JarusHub for more articles on tax and careers in general

[subscribe2]

Established in March 2013, JarusHub is a Nigerian information hub with focus on career and management. It is rated Nigeria's most authoritative destination for online career resources. It parades an array of Nigerian professionals who share their career experiences with a view to bridging career information gap and mentoring a generation to success. Whether you're a student, a recent graduate or an established professional, or even an executive, you will always find something to learn on JarusHub. All enquiries to jarushub@gmail.com or 0808 540 4500. Facebook: www.facebook.com/jarushub; Twitter: @jarushub or @mcjarus.

JARUS IS NOT JARUSHUB

July 24, 2017

5 comments

Let us have your say by leaving a comment belowCancel reply

Recommended For You

-

Advise him: To continue with Dentistry or rewrite UTME for Medicine?

February 16, 2014 -

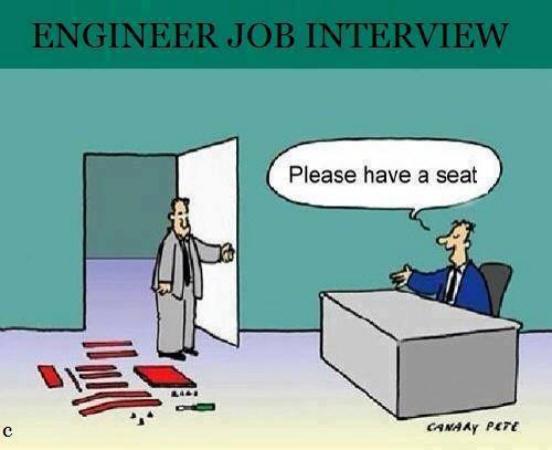

HOW TO DO WELL IN ENGINEERING JOB INTERVIEWS

November 7, 2014

It is unimaginable what Nigeria and its component federating units, states, have lost and still losing to tax evasion. It is never too late to reverse the gear and drive towards a sustainable tax enhanced, if not driven, economy. The time is now and this is why is your intervention on tax enlightenment is commendable. Untill now when i got absorbed into a strictly formal kind of employment where tax evasion is impossible (PAYE), i had equally ensured that i pay my taxes (PITA) even though i was practically outside the tax net. Indeed, there is this psycological relief and some sense of responsibility coming with being a tax payer.

Yes, Mislaw. That’s the spirit. There is this relief that comes with paying taxes, although, naturally, man doesnt like paying taxes.

Honestly i appreciate how you are able to dealt extensively with the tax issue bt i have reservations and some observations, those that pioneered the tax and revenue generation right from the military era, i mean Cheif Olushola Adekanola FCA and his then partner Dr AWA Ibraheem FCA,FCTI,FCMA(a first class graduate of accounting that never attend a secondary school), they started with ARG……accelerated revenue generation which they use to consult for Lagos and another 22 states or there about before the later went solo and formed his own company ICMA Services which consult for 6 states of the federation with the innovation of REEMS revenue enhancement and electronic monitoring scheme which is the nucleus of revenue consulting now….they both were the front runners before Alpha beta steal from thier innovation. I think Dr Awa Ibraheem deserved to be put on this blog has this harvard graduate has an inspiring story that can inspire alot of Nigerian. Thanks

Thanks. I will try and feature Dr Ibraheem too

Good innovation here. i am currently writing my project on effect of tax evasion and avoidance, i wuld b most obliged if tax scholars can be made to contribute on this platform to further enhance my research.