(Over 20 years investing experience in Nigeria’s financial markets)

A share is a unit of ownership in a company. In other words, when you buy shares of a company you become part owner of the company and have the rights to share from the fortune of company and contribute to major decisions at the Annual General Meeting of the company.

What are the benefits of investment in shares?

The benefits are numerous, however I will mention just a few:

1. COLLATERAL: It serves as collateral, whenever we need loan from the bank. It is easier to use as collateral than using buildings. No need of certificate of occupancy, no need of evaluation by estate valuers. By looking at your shares certificates or CSCS statement, the bank manager knows the value of the shares and you also know. Shares are the most preferred collateral security because of its liquidity.

2. DIVIDENDS: As a part owner of a company, you are entitled to dividends. Dividend is a cash reward made by a company to its owners out of the profit made at the end of a financial year. The amount of dividend received is determined by the volume of your shareholding.My mother used the dividend she received between 2000 and 2003 to build 2 units of 3 bedroom flats in Lagos.

3. BONUS SHARE: This is similar to dividend but it does not involve cash payment. When a company gives bonus shares, it means every shareholder is entitled to additional free shares. N3500 used in buying 1000 units of First Bank shares in 1993 have grown to over 54,000 units valued at almost N900000 in 2013 due to bonus shares and growth of the company.

4. CAPITAL APPRECIATION: Shares of companies may appreciate due to the forces of demand and supply, growth of the company, management competence or growth in the economy.

5. LIQUIDITY: Shares of blue chip companies are very liquid; it can be easily converted to cash. One million units of Nestle shares valued at over N1 billion can be converted to cash within a week, whereas a property valued at N100 million can be in the market for a year or more.

6. ASSET OWNERSHIP: Like the way you acquire and own land, buildings, cars, jewelries etc, which are assets, when you buy shares they become part of your assets. You may decide to sell some units of your shares whenever the need arises to enhance your liquidity position.

7. RISK DIVERSIFICATION: Shrewd investors have a portfolio of investments that includes money market instruments, bonds, shares, real estate etc.Shares afford the opportunity to spread risks by investing in different companies and different sectors of the economy.

8. SAVINGS: Investing in shares avails you the opportunity to save your income in assets that have a high degree of security. Earnings that otherwise will be spent in consumption can be invested in shares, which income yielding ability is in perpetuity. One of the most effective saving habits is to commit a given percentage of your monthly earnings to investment in shares.

9. PRESTIGE: It is honourable to be part owner of a company with great reputation and excellent corporate image.

10. TRANSFERABILITY: You can transfer your shares to your beneficiaries as gift during your lifetime and upon death. You can also buy shares for your children when they are young, by the time they graduate the money will be more than enough to start a business or fund their post graduate studies.

11. POTENTIAL DIRECTOR: When you own up to 5% of a quoted company, you will definitely have a say in the board of the company. A major acquisition of over 50% of the equity of a company gives the shareholder total control of the company.

12. RETIREMENT PLANNING: Investment in shares is a very good way of planning for retirement. It is a strong motive for share investment. A time will come when one is no longer active to move up and down. The dividends from shares provide regular flow of income to keep life going. Shares could also be sold to meet some medical expenses at old age.

13. FINANCIAL PLANNING STRATEGY: Smart workers or salary earners have a financial plan, some want to build a house, retire young, start a business, or create additional stream of income. No matter what your plans are, investment in shares can assist one in achieving any of these goals.

14. WEALTH CREATION: Intelligent and long term investment in shares of good companies is a wonderful way of creating lasting wealth.Successful stock market investors are silent millionaires and billionaires, they have a high net-worth and own so much, but most people do not know. I was impressed when an elderly man who is close to 80 years made a donation of N10 million, during a fund raising exercise in my church which I co-ordinated for victims of Bokom Haram in Northern Nigerian. This impressive donation for a noble cause made me to get closer to Baba, and found out that the man is a veteran in stock market investment. I now have Baba as one of my mentors.

…………………………………………………………………………………………………………………………………………………

Memorable investment quotes

Share buying is a vital opportunity to build up a fortune; it is a way of saving for self and the nation.

Akintunde Asalu

Established in March 2013, JarusHub is a Nigerian information hub with focus on career and management. It is rated Nigeria's most authoritative destination for online career resources. It parades an array of Nigerian professionals who share their career experiences with a view to bridging career information gap and mentoring a generation to success. Whether you're a student, a recent graduate or an established professional, or even an executive, you will always find something to learn on JarusHub. All enquiries to jarushub@gmail.com or 0808 540 4500. Facebook: www.facebook.com/jarushub; Twitter: @jarushub or @mcjarus.

5 comments

Let us have your say by leaving a comment belowCancel reply

Recommended For You

-

IMPORTANCE AND TIDBITS OF MBA

September 17, 2014 -

Notes on Income Streams

August 27, 2013 -

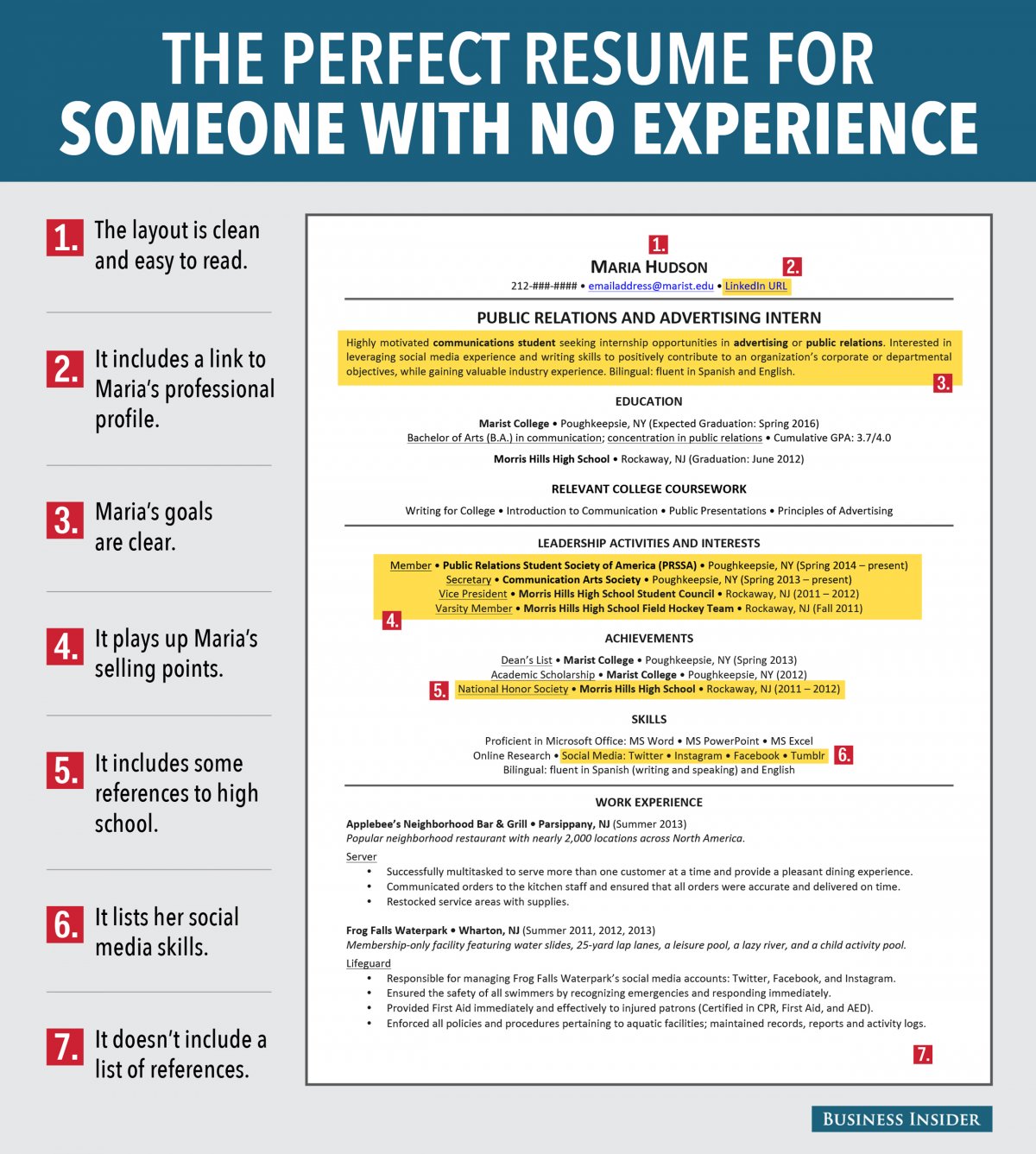

THE PERFECT RESUME FOR AN ENTRY LEVEL APPLICANT

August 13, 2014

I forgot to include in the article the true life story of an old friend who we grew up in the same neighbourhood. His late father was the Financial Director of one of the old conglomerate listed on the stock exchange.

When the guy graduated as a civil engineer from Yaba Tech in 1997, his father handed over the shares he had being investing on his behalf to him. The stocks were valued at close to N6 million when he finished his NYSC in 1998. The guy used part of the money to invest in real estate and set-up a civil engineering company.

15 years after NYSC, Tayo has done jobs for Ikeja, Oshodi, Isolo, Alimosho, Ijora, Ibeju, Sagamu, Ota local goverment areas in Lagos and Oguns states. He also has an enviable portfolio of stocks and real-estate, he also has another company that builds and sells houses.

If not for the foresight of his father, he may be among the numerous HND holders who are complaining of the discrimination they encounter from employers about HND certificates. He has B.Sc and Masters degree holders working for him full time and part time as Architects, Building Technologist, Accountants, Quantity Surveyors, Lawyers etc.

i will like to invest 10k monthly on any share .Kindly intimate me with share

It is better to start will little amount which will be invested regularly by so doing you learn, be interested about the economy, and the companies you invest in.

My brokers will not accept 10k as initial investment, but I can recommend stockbrokers that will accept as little as 20k.

As your portfolio gets to 7,8 or 9 digits, you can transfer your stockbroking account to some of the big houses. I think you have a lot to gain when you trade some of the biggest stockbroking houses in Nigeria.

Thanks for sharing. I only need to increase my efforts in this area.

Great post.

[…] https://www.jarushub.com/14-benefits-of-shareholding/ […]